How to Profit from an ADU in 2026 in Texas, North Carolina, and Florida

- Dec 29, 2025

- 4 min read

Updated: Dec 29, 2025

How to Profit from an ADU in 2026

JRH Engineering & Environmental Services is excited to share insights on maximizing profits from Accessory Dwelling Units (ADUs) in 2026. At JRH Engineering & Environmental Services, our motto is "Done Quickly. Done Right. And for the Best Value." We consistently deliver professional design and permitting services in the states of Texas, North Carolina, and Florida, helping property owners, developers, and contractors transform underutilized spaces into revenue-generating assets.

Whether you're a homeowner looking to boost rental income or a developer scaling multi-unit projects, this guide answers common search queries like:

"How much can I profit from an ADU?"

"What is the ROI on an ADU in Texas?"

"ADU permitting costs in Florida,"

"Best ways to monetize a granny flat in North Carolina."

We'll break down the process with practical steps, costs, and strategies to ensure your ADU not only complies with local regulations but also delivers strong financial returns.

Understanding ADUs and Their Profit Potential

An ADU, often referred to as a granny flat, guest house, casita, or backyard cottage, is a secondary living unit on your property.

In 2026, ADUs are booming due to housing shortages and remote work trends, with profits coming from rental income, property value increases, and tax benefits.

JRH provides professional design and permitting services in Texas, North Carolina, and Florida, ensuring your ADU is built to last and profit.

Common search query answered:

"What is the average profit from an ADU?"

Nationally, ADUs can generate $1,500–$3,000 monthly in rent, with ROI of 8–15% after costs.

In Texas, expect 10–12% ROI

North Carolina 9–14%

Florida 11–16% due to tourism.

Rental Income Streams:

Long-term rentals: Steady cash flow for families or professionals.

Short-term (Airbnb): Higher yields in tourist areas like Orlando or Charlotte.

Family use: Indirect profits via multigenerational living tax deductions.

Property Value Boost:

ADUs add 20–30% to home value, per Zillow data

$50,000–$100,000 increase on average.

JRH's services ensure your ADU design maximizes space for profitability, like adding energy-efficient features to reduce utility costs.

Step-by-Step Guide to Building a Profitable ADU

Building an ADU involves planning, design, permitting, and construction.

JRH provides professional design and permitting services in Texas, North Carolina, and Florida, streamlining the process to get you renting faster.

Common search query answered:

"How do I build an ADU to make money?"

Steps for a profitable outcome:

1. Assess Feasibility and Profit Potential:

Evaluate your lot for zoning compliance.

In Texas (no statewide zoning), focus on local ordinances

North Carolina requires a septic system if there is no sewer system

Florida emphasizes concurrency

2. Design for Maximum Revenue:

Create layouts that include kitchens, baths, and separate entrances for appeal.

Design tips:

Add laundry and parking for higher rent.

Use sustainable materials for tax credits.

Size optimally: 600–1,200 sq ft yields best ROI.

3. Navigate Permitting and Regulations:

JRH handles submissions to ensure approval—Done Quickly. Done Right. And for the Best Value.

State-specific requirements:

Texas: Building permit fees $500–$2,000; 4–12 weeks.

North Carolina: $300–$1,000; 2–8 weeks, with septic checks.

Florida: $500–$2,500; 4–10 weeks, flood elevation mandatory.

4. Construction and Cost Management:

Average costs $50,000–$200,000; JRH optimizes designs to cut 10–20%.

Bullet points for cost-saving:

Prefab options reduce labor.

Energy-efficient upgrades for rebates.

5. Marketing and Monetization:

List on Airbnb or Zillow

Aim for 80% occupancy.

Monetization strategies:

Price competitively: $1,500–$3,000/month.

Offer utilities included for the premium.

Use ADU as a home office for tax write-offs.

This process, with JRH's support, can achieve payback in 5–7 years.

State-Specific Profit Strategies for ADUs

JRH provides professional design and permitting services in Texas, North Carolina, and Florida, tailoring to local markets for maximum profits.

Common search query answered:

"How profitable are ADUs in Texas?"

With low costs and high demand, expect $20,000–$40,000 annual net profit.

Texas ADU Profits:

High-migration areas like Austin/Houston: Rent $1,800–$2,800/month.

Tax benefits: No statewide ADU tax hikes; homestead exemptions.

JRH tip: Integrate windstorm designs for insurance savings.

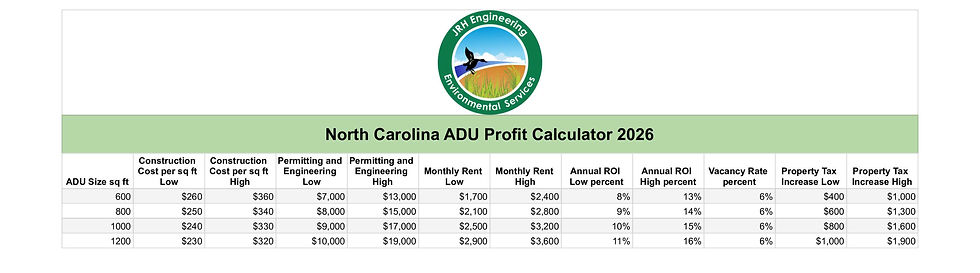

North Carolina ADU Profits:

Growing metros like Charlotte/Raleigh: Rent $1,600–$2,600/month.

Incentives: Loans for affordable ADUs in Durham.

JRH tip: Add septic engineering for rural lots.

Florida ADU Profits:

Tourist hotspots like Orlando/Tampa: Short-term rent $2,000–$3,500/month.

Exemptions: Tax breaks for family ADUs.

JRH tip: Hurricane-resilient designs reduce repair costs.

JRH's expertise ensures your ADU complies and profits—Done Quickly. Done Right. And for the Best Value.

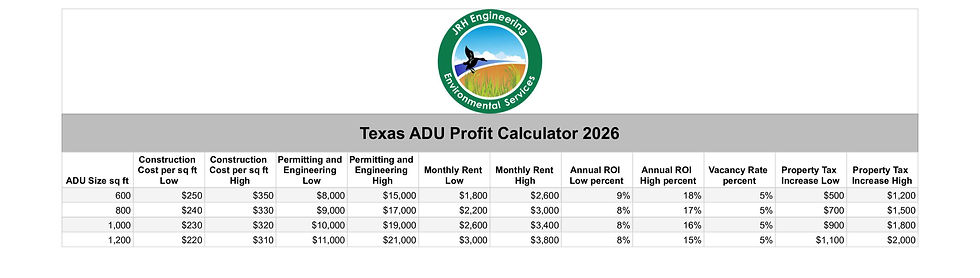

Calculating ADU ROI and Costs

Common search query answered: "What is the ROI on an ADU in Florida?" Typically 10–15%, with payback in 4–6 years on $60,000–$180,000 costs.

Cost Breakdown:

Planning and Design: $3,000–$6,000 (JRH provides sealed plans).

Permitting: $500–$2,500 (state-varying).

Construction: $50,000–$150,000 (labor/materials).

Utilities/Finishing: $5,000–$10,000.

ROI formula: (Annual Rent - Expenses) / Total Cost × 100. JRH's designs minimize expenses through efficient layouts.

Boosting ROI:

Choose high-demand locations.

Add amenities like AC for premium rent.

Leverage tax credits (e.g., Florida's for affordable units).

Legal and Regulatory Considerations

Common search query: "Are ADUs legal in North Carolina?"

Yes, under SB 495, with local approvals.

Texas: No statewide ban; local rules apply.

North Carolina: Encouraged for affordability; owner occupancy often required.

Florida: HB 1029 promotes ADUs; no special zoning needed.

Comments